Establishing a strong financial foundation is essential for achieving long-term stability and independence. These seven money principles offer practical, actionable guidance for managing personal finances effectively—no matter your age or stage of life.

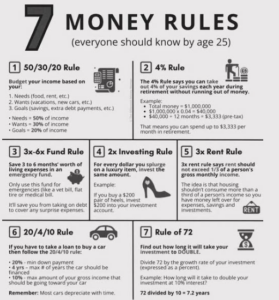

1. Apply the 50/30/20 Rule to Manage Your Budget

This simple budgeting strategy divides after-tax income into three categories:

- 50% Needs: Essential expenses such as rent, groceries, and utilities

- 30% Wants: Discretionary spending like dining out, entertainment, or hobbies

- 20% Goals: Savings, investments, and debt repayment

2. Use the 4% Rule for Retirement Planning

The 4% rule helps estimate how much you can safely withdraw from retirement savings annually without exhausting your funds over a 30-year period. For example, a $1,000,000 portfolio would allow for a $40,000 annual withdrawal.

3. Build a 3 to 6-Month Emergency Fund

Prepare for unexpected events by saving three to six months of living expenses. Use this fund only for genuine emergencies such as job loss, medical bills, or urgent repairs. It prevents reliance on high-interest debt in times of crisis.

4. Implement the 2x Investing Rule for Smart Spending

Match luxury purchases with equal investments. If you spend $300 on a new gadget, also invest $300 in a long-term account. This balances enjoyment with future financial security.

5. Follow the 3x Rent Rule for Housing Affordability

To avoid becoming house-poor, monthly rent should not exceed one-third of gross monthly income. If your income is $3,600, your rent should stay at or below $1,200.

6. Apply the 20/4/10 Rule When Financing a Car

- Put down at least 20% of the car’s price

- Choose a loan term no longer than 4 years

- Ensure total car expenses (loan + insurance) do not exceed 10% of your gross monthly income

7. Use the Rule of 72 to Estimate Investment Growth

This rule estimates how long it will take for an investment to double in value based on its annual return. Divide 72 by your interest rate. At 8%, it takes roughly 9 years to double your money.

Conclusion

Understanding and applying these 7 money principles can lead to smarter financial decisions, greater peace of mind, and a clearer path to financial independence. No matter where you are on your journey, these foundational rules are universally valuable.

Frequently Asked Questions

What if I can’t follow all seven money principles right away?

Start where you can. Progress is more important than perfection. Even small steps, like saving a few dollars weekly, build lasting habits over time.

Is the 50/30/20 budget flexible?

Yes. While it’s a reliable guideline, you can adapt the percentages to suit your income level, cost of living, and financial goals.

How does the Rule of 72 work?

The Rule of 72 estimates investment doubling time by dividing 72 by the annual return rate. It’s a useful tool for understanding compound growth over time.

Can the 4% rule apply to early retirement?

For early retirees, a more conservative withdrawal rate of 3–3.5% may be advisable to account for a longer retirement horizon and inflation.

Why should I build an emergency fund if I have credit cards?

Emergency funds reduce dependency on credit cards, which typically carry high interest rates. Cash reserves provide financial flexibility without added debt.