(Newswire.net — October 24, 2014) Syosset, NEW YORK —

Recent generations of Americans have grown up with a picture of retirement that’s based on their parents and grandparents: Stopping working at around age 65 or sooner in order to spend the rest of their lives traveling, visiting children and grandchildren, indulging in hobbies and recreation, and volunteering to support their favorite causes.

But how realistic is this idyllic scenario for baby boomers and members of Generation X and Y? Not very, according to a survey conducted by HSBC

Retirement Shortfalls and Pessimisms

Respondents in the U.S. said they expect their retirement to last for 21 years, but their retirement savings to last only 14 years, leaving a retirement shortfall of 33 percent. 18 percent of respondents in the U.S. said they don’t think they will ever retire, at least in the traditional sense of giving up work completely.

Among those questioned in the survey who had already retired, almost half said they haven’t been able to realize their pre-retirement plans because they have less money available than they expected to meet their everyday living expenses and .

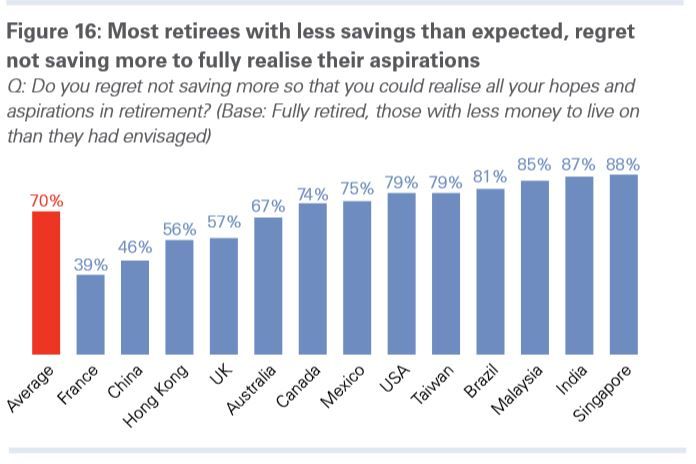

According to the study, high levels of unemployment, low wage growth and depressed savings rates have made living the “dream retirement” unrealistic for many Americans. 79 percent of Americans with a retirement shortfall regret not saving more, so that they could realize their retirement aspirations.

Image from HSBC The Future of Retirement Report

Increasing life expectancies, a higher cost of living (especially housing and college educations for their children) and the need to possibly continue supporting their adult children due to the difficult job market are other factors the study attributed to the pessimism many respondents voiced when it comes to retirement.

Unfortunately, this financial pessimism appears to be supported by recent consumer sentiment data from the Consumer Reports Index . The Index’s measurement of consumer stress rose from 53.7 to 58.0 in 2013 and was 55.7 in Spetember 2014. The Consumer Reports Trouble Tracker measure, which gauges negative financial events for individuals and their difficulty in paying bills, is better than it was in 2013, but it climbed to 39.2 in September 2014 from 34.0 just a month earlier.

Focus On Your Own Retirement Goals

David Lerner Associates Executive Vice President Martin Walcoe stresses that while the survey data may paint a bleak retirement picture for many Americans, that doesn’t mean any individual’s or couple’s retirement plans have to be derailed.

“It’s easy to read surveys and reports like these and think retiring is a pipe dream, so why even try to save for retirement,” says Walcoe. “But these are just broad statistics of the population as a whole — they don’t have any impact at all on any particular individual’s or couple’s retirement prospects. Whether or not you are able to retire comfortably, when you want to, is primarily dependant on when you start saving for retirement, how much you save, and how wisely you invest your retirement savings.”

Walcoe encourages couples and individuals to focus less on what the media and pundits are saying about retirement, and more on their own retirement savings strategies. “Set goals for how much you think you need to save in order to retire comfortably at a target age, and then work backward from here to determine how much money you need to save each month to meet these goals.

“While there are a lot of uncertainties involved in such an exercise — such as rate of return, inflation and the future cost of healthcare — at least this will give you some kind of target to shoot for.”

For more infomraoitn on saving for retirement visit http://news.davidlerner.com/retirement_index.php

Material contained in this article is provided for information purposes only and is not intended to be used in connection with the evaluation of any investments offered by David Lerner Associates, Inc. This material does not constitute an offer or recommendation to buy or sell securities and should not be considered in connection with the purchase or sale of securities. Member FINRA & SIPC

About David Lerner Associates

Founded in 1976, David Lerner Associates is a privately-held broker/dealer with headquarters in Syosset, New York and branch offices in Westport, CT; Boca Raton, FL; Teaneck and Princeton, NJ; and White Plains, NY. For more information contact David Lerner Associates http://www.davidlerner.com (800) 367-3000