Strategic consolidation. Innovation engine. Growth catalyst. We can think of many other names for mergers and acquisitions that describe this deal’s power. However, something remains unchanged: the success of a merger of two companies depends on smooth integration. Just as a puzzle’s pieces must fit together seamlessly to reveal the complete picture, integrating two businesses requires careful alignment of strategies, cultures, processes, and resources.

In our post, we will explore the key benefits of mergers and acquisitions for growth and innovation, outline what you need to succeed, and introduce data rooms for due diligence that streamline the deal process.

To begin at the end: What are virtual data rooms?

During our discussion about the benefits of mergers and acquisitions for your growth, we will also cover software support options. Therefore, it is essential to understand the solution we are referring to.

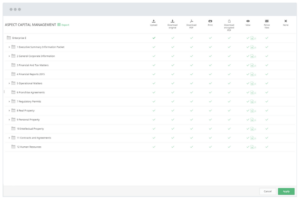

A virtual data room is a secure platform designed explicitly for M&A deal makers. It streamlines the deal through the following features:

- Secure document storage – store and organize sensitive documents related to the transaction

- Controlled access – set granular user access controls to protect specific documents

- Secure collaboration – review, annotate, and discuss documents within the platform using secure messaging, Q&A hubs, and real-time notifications

- Document version control – access the most up-to-date information and maintain data integrity throughout the procedure

- Compliance and regulatory support – comply with industry regulations and data privacy laws, such as GDPR and HIPAA

- User-friendly interface – easily navigate the platform and access the information you need from any location

Data room interface example. Granular user permissions

These are just some of the features offered by virtual data room providers. So, we recommend exploring the best vendors to learn more. This way, you will see full functionality and ensure that the product can strongly support your procedure.

Top five M&A benefits for your business growth

Check the deal’s main advantages, what you need for success, and how virtual data room solutions can assist in achieving your goals.

1. Knowledge transfer and learning opportunities

Employees can learn from each other’s expertise, best practices, and processes. It encourages professional development and skill enhancement across the organization.

What you need for the best outcome:

- Structured mentorship and knowledge-sharing programs

- Platforms for continuous learning, such as online courses, workshops, and seminars

- A supportive organizational culture that values continuous learning and encourages employees to share knowledge and experiences openly

✔ Data room support

Built-in tracking and analytics features provide insights into employee engagement with learning materials. It helps organizations tailor training programs to address skill gaps and learning needs.

Get more insights: Explore the difference between horizontal merger and vertical merger

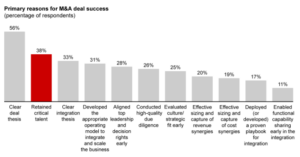

2. Talent retention

M&A activities create new career opportunities for employees within the combined entity. It increases job security, talent retention, and upward mobility, as employees can access a broader range of roles and opportunities for professional growth.

Source: Reimagining Talent in M&A | Bain & Company

What you need for the best outcome:

- Robust talent development programs that offer career advancement opportunities and skill development

- Transparent communication about career progression and opportunities

- Recognition and rewards programs that acknowledge and appreciate employees’ contributions and achievements

✔ Data room support

Virtual data rooms for mergers and acquisitions boost ongoing communication between management and employees through secure messaging and collaboration features. Thus, you can build a culture of transparency and trust, which can contribute to talent retention.

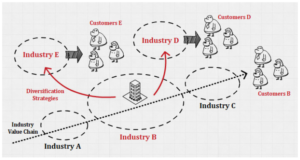

3. Sustainability

Diversifying income streams and expanding market reach through M&A can help teams withstand market fluctuations and manage economic uncertainties better.

Source: Basic Concepts of Diversification Strategies

What you need for the best outcome:

- Investment in sustainable business practices that prioritize environmental stewardship, social responsibility, and ethical business conduct

- Risk management processes that anticipate and mitigate economic turbulence

✔ Data room support

All employees can quickly retrieve relevant information using advanced search and indexing capabilities during strategic planning meetings, ensuring informed decision-making and proactive risk mitigation. Furthermore, a dataroom facilitates collaboration between cross-functional teams involved in sustainability initiatives, allowing them to track progress and monitor compliance with environmental, social, and governance standards.

4. Innovation catalyst

Mergers and acquisitions combine talents, technologies, and ideas. Most often, it helps to achieve breakthroughs in product development, service delivery, and business models.

What you need for the best outcome:

- A culture of innovation that encourages experimentation, creativity, and collaboration across departments and teams

- Cross-functional teams dedicated to exploring new ideas, technologies, and business models resulting from M&A activities

✔ Data room support

Through secure document sharing and version control features, data room providers support the exchange of intellectual property, research findings, and innovative ideas. This way, all parties can rest assured that valuable knowledge assets are protected while encouraging knowledge sharing and collaboration.

5. Globalization

The deal facilitates global business development strategies and provides access to new markets and regions. This expansion opens growth opportunities, diversified revenue streams, and enhances businesses’ global footprint, driving long-term growth.

What you need for the best outcome:

- Comprehensive market research and analysis that identifies opportunities and challenges in new markets

- Cross-cultural competency training to manage cultural differences and engage with global stakeholders

- Localization strategies tailored to specific markets, including adapting products, services, and marketing strategies to meet local preferences and regulations

✔ Data room support

The best virtual data room solutions enable businesses to securely share market research, competitor analysis, and regulatory information. In addition, customizable access controls ensure only authorized stakeholders have access to sensitive information. Data rooms also facilitate employee training by sharing all relevant resources in an easy-to-use space.

Final thoughts

Mergers and acquisitions can present a good opportunity for a business to make a breakthrough. However, these deals require time and effort. Fortunately, data rooms simplify the M&A lifecycle by providing a platform specifically designed for this purpose.

So, research the available providers and their offerings. Determine what virtual data room pricing is acceptable for your needs and choose the product that offers the best balance between price and quality. With data rooms, you can successfully merge businesses and reach new heights.